Computer vision cost analysis is becoming a critical skill for organizations integrating AI into real-world operations. As vision-based systems move from pilots to production, financial decisions become just as important as technical ones. Leaders are no longer asking whether computer vision works. They are asking how to pay for it wisely.

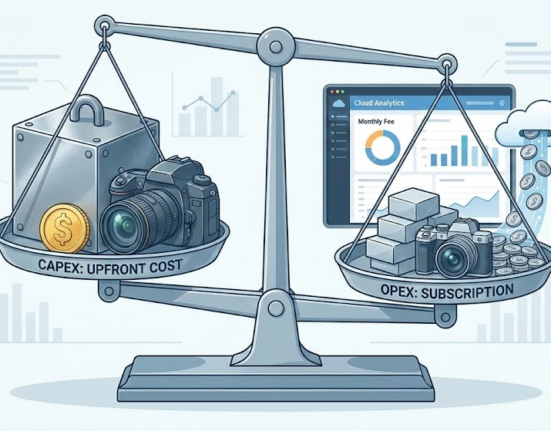

At the heart of the discussion sits a familiar tension. Should investment lean toward capital expenses or operational expenses? Should systems be built and owned, or consumed as services over time? The answers shape scalability, risk, and long-term productivity.

This article explores how to evaluate capital versus operational expenses for computer vision integration. It explains the trade-offs, highlights hidden costs, and offers a framework for making sustainable financial decisions.

Why Computer Vision Cost Analysis Matters Early

Cost decisions made early tend to linger for years. Computer vision systems are not simple plug-ins. They touch hardware, software, data pipelines, and people.

Computer vision cost analysis matters because it:

- Prevents underestimating long-term expenses

- Clarifies financial risk before deployment

- Aligns technical design with budget reality

- Supports executive decision-making

Without structured analysis, teams often commit to architectures that are difficult to scale or maintain.

Understanding Capital Expenses in Computer Vision

Capital expenses usually involve upfront investment. Hardware is purchased. Infrastructure is owned. Systems are depreciated over time.

In computer vision projects, CapEx often includes:

- Cameras and imaging hardware

- Edge computing devices

- On-premise servers

- Networking equipment

- Installation and integration costs

These investments create ownership and control. However, they also lock in decisions early.

Computer vision cost analysis must account for depreciation, maintenance, and eventual replacement. What looks affordable today may become expensive tomorrow.

Operational Expenses in Computer Vision Integration

Operational expenses grow gradually. Instead of owning assets, organizations pay for usage, subscriptions, or managed services.

OpEx in computer vision typically includes:

- Cloud computing and storage

- AI model hosting and inference

- Software licensing

- Data labeling services

- Ongoing support and monitoring

Operational spending offers flexibility. Costs scale with usage. Yet, over time, recurring fees can exceed initial expectations.

A strong computer vision cost analysis compares total lifetime costs, not just entry price.

Hardware Ownership vs Vision-as-a-Service

One of the biggest decisions involves ownership.

Owning hardware means control. Vision-as-a-service means convenience. Each approach shifts costs differently.

Ownership advantages include:

- Lower long-term unit costs

- Reduced dependency on vendors

- Predictable infrastructure behavior

Service-based models offer:

- Faster deployment

- Lower upfront investment

- Easier scaling during demand spikes

Computer vision cost analysis must weigh predictability against flexibility.

Edge vs Cloud Processing Cost Considerations

Where vision processing occurs affects both CapEx and OpEx.

Edge processing often increases capital expense. Devices must be powerful and distributed. However, it reduces cloud usage and latency.

Cloud-based processing shifts costs toward operations. Compute is consumed as needed. Scaling is easier.

Cost trade-offs include:

- Bandwidth consumption

- Latency requirements

- Data privacy constraints

- Maintenance responsibility

Balanced architectures often mix both approaches.

Data Costs Often Overlooked

Computer vision cost analysis must include:

- Data collection and storage

- Annotation and labeling

- Quality validation

- Retention and compliance

These expenses persist regardless of deployment model. Ignoring them distorts ROI projections.

Scaling Impacts CapEx and OpEx Differently

Scaling exposes financial weaknesses.

CapEx-heavy models scale through additional purchases. OpEx-heavy models scale through higher usage fees.

Scaling considerations include:

- Marginal cost per additional camera

- Inference cost per frame

- Storage growth over time

- Monitoring overhead

Computer vision cost analysis should simulate growth scenarios, not just current needs.

Maintenance and Upgrade Cycles

Vision systems age quickly. Sensors degrade. Models drift. Software evolves.

Maintenance costs appear differently depending on spending model.

CapEx maintenance includes:

- Hardware repairs

- Firmware updates

- On-site support

OpEx maintenance includes:

- Subscription increases

- Service tier upgrades

- Vendor-driven changes

Forecasting these cycles prevents budget surprises.

Risk Distribution Between CapEx and OpEx

Risk allocation matters.

Capital-heavy investments concentrate risk upfront. Operational models spread risk over time.

Key risk factors include:

- Technology obsolescence

- Vendor dependency

- Performance uncertainty

- Regulatory changes

Computer vision cost analysis should align risk tolerance with spending structure.

Security and Compliance Cost Factors

Vision systems often handle sensitive data.

Security and compliance introduce both capital and operational costs.

Examples include:

- Secure hardware modules

- Encrypted storage

- Access control systems

- Audit and reporting tools

Compliance costs persist throughout the system lifecycle and should never be treated as one-time expenses.

Human Costs in Vision System Operations

People costs matter as much as technology.

Computer vision integration requires skills across engineering, operations, and governance.

Human-related expenses include:

- Specialized staffing

- Training and reskilling

- Operational oversight

- Incident response

Whether capitalized or operational, these costs influence sustainability.

Total Cost of Ownership as a Decision Lens

Total cost of ownership brings clarity.

Rather than debating CapEx versus OpEx in isolation, computer vision cost analysis should evaluate end-to-end cost.

TCO includes:

- Acquisition

- Deployment

- Operation

- Maintenance

- Retirement

This perspective prevents false savings.

Balancing Financial Flexibility and Control

Flexibility feels attractive. Control feels safe.

CapEx offers ownership and predictability. OpEx offers agility and speed.

Balanced strategies often combine both. Core systems may be owned. Variable workloads may be serviced.

Computer vision cost analysis supports hybrid strategies grounded in reality.

Aligning Cost Structure With Business Goals

Technology decisions should reflect business intent.

Cost structures align differently with goals such as:

- Rapid experimentation

- Long-term standardization

- Regulatory stability

- Market expansion

There is no universal answer. Context defines value.

Avoiding Common Cost Evaluation Mistakes

Cost evaluations often fail due to optimism.

Common mistakes include:

- Ignoring scaling effects

- Underestimating data costs

- Overlooking human effort

- Assuming static pricing

Disciplined computer vision cost analysis avoids these traps.

Building a Financial Roadmap for Vision Integration

Roadmaps reduce uncertainty.

A strong roadmap phases investment logically. Early pilots may favor OpEx. Mature deployments may justify CapEx.

Roadmaps support:

- Budget planning

- Stakeholder alignment

- Risk management

- Long-term sustainability

Financial clarity accelerates adoption.

Conclusion

Computer vision cost analysis is not about choosing capital or operational expenses in isolation. It is about understanding how each shapes scalability, risk, and long-term value. By evaluating total cost of ownership, data expenses, maintenance cycles, and human effort, organizations can integrate computer vision systems confidently.

When cost decisions align with strategy, vision technology becomes an asset rather than a burden. Thoughtful analysis turns financial trade-offs into competitive advantage.

FAQ

1. What is computer vision cost analysis?

It is the evaluation of all capital and operational expenses involved in deploying and maintaining computer vision systems.

2. Is CapEx or OpEx better for computer vision integration?

Neither is universally better. The right choice depends on scale, risk tolerance, and long-term goals.

3. What are the biggest hidden costs in computer vision projects?

Data labeling, maintenance, scaling, and staffing are often underestimated.

4. How does cloud usage affect computer vision costs?

Cloud services reduce upfront costs but can increase long-term operational expenses if usage grows.

5. Why is total cost of ownership important?

It captures the full lifecycle cost, preventing misleading short-term savings decisions.